Online savings calculators are a helpful tool for students learning to save for their goals

- Jun 3, 2023

- 3 min read

Updated: May 5, 2025

June 3, 2023

By Lidya Teklebirhan

Youthcast Media Group®

How much would you need to save and for how long to get a car, pay for college or even go on the trip of your dreams? All of this can be planned with the use of an online savings calculator.

Online calculators can help you see your way to all your desires by helping you set clear checkpoints to help you reach your goals.

“With online calculators, you can try different scenarios such as saving $100 each month and seeing how much you would save in a span of five years or more,” said Sandra Block, senior editor at Kiplinger’s Personal Finance magazine.

Bankrate.com has a free savings calculator to estimate the growth of your investments over time. This growth calculator can help you work out the interest on your Individual Retirement Account (IRA), help you figure out how long it'll take to save for a down payment on a house and calculate deposit growths. It can also help you set monthly goals and figure out how much you should save each month to reach your goal.

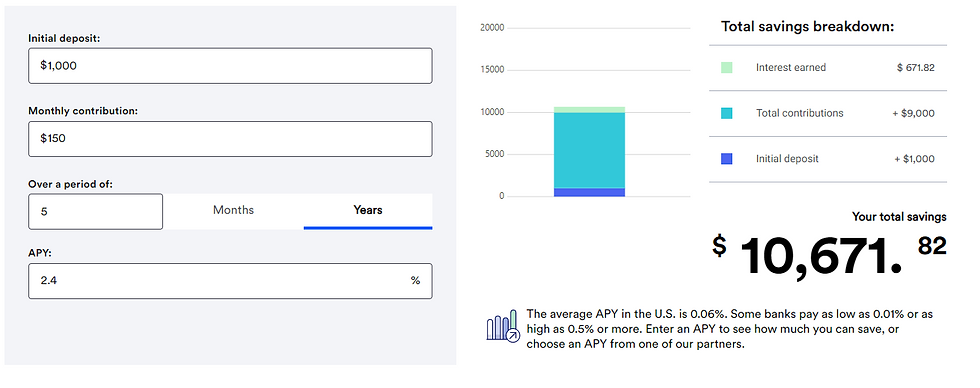

If you plan on saving to buy a used car, you could start as early as high school. According to Bankrate.com, with an initial deposit of $1,000 and a monthly contribution of $150, in five years you will end up with just over $10,600 saved. If college is in your future, that’s enough for a 60-month car loan down payment and over a year of monthly payments by the time you graduate with a four-year degree. Still you’ll probably need a cosigner with a good credit score to apply.

If you already know how much you want to save over a period of time, Investor.gov is for you. Their savings goal calculator allows you to enter your goal, initial investments and the number of years you plan to save to give a clear amount that you should deposit monthly.

Perhaps you want to start a travel fund to save $2,000 over the next two years. According to Investor.gov, with an initial investment of $100 and monthly contributions of $78.98, you could eventually have enough for a vacation for one.

TheMint.org provides another savings calculator that allows you to plan the amount of money you would like to save, spend, invest and give based on your weekly income. With this, you will be able to find how much money you would end up with within a year.

If you’re planning to save for a shorter term goal like a new game console, TheMint.org can show how much you could save in a year. If you make $100 weekly at a part-time job, you could save 30% of that money to collect a total of $1,560 in one year. The PlayStation 5 is around $500, leaving you with enough for a gaming chair and additional gaming accessories.

Setting goals for yourself when saving money is important because it gives you a clear image of what you are trying to achieve. Whether it is a closer goal such as college or a long-term financial goal like retirement, having an idea of what you want to save up for can drive you to work harder to reach the end goal.

“Saving money without having a goal is like playing a football game without touchdowns.” Susan Beacham, founder and CEO of Money Savvy Generation, said. “It's boring. It's just boring.”

Once you have conceptualized that goal, Beacham recommends a next step.

“Draw a picture of it, write a word on a piece of paper. Put it anywhere that you’re going to have to pass every single day to remind yourself, ‘This is why I’m saving money.’”

Lidya Teklebirhan is a 9th grade student at Annandale High School in Annandale, Va., and reported and wrote this story in collaboration with Youthcast Media Group’s team of mentoring reporters.

Comments